update on mn unemployment tax refund

All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

House Workforce Committee Oks 1 2 Billion Plan To Repay Mn S Unemployment Trust Fund Session Daily Minnesota House Of Representatives

If you have a PO.

. MINNEAPOLIS WCCO The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes. Box your address should include PO. The Taxable wage base for 2022 is 38000.

Working through the summer and early fall to update 2020 tax forms to reflect the law changes made in July. As of January 27 2022 we have. You can update your address online or by calling Customer Service.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. There is no need for taxpayers to file an amended return unless the calculations make. Minnesota to process refunds for unemployment insurance paycheck protection program.

Update Unemployment Exclusion. The internal revenue service has been issuing unemployment refunds for those who overpaid while filing 2020 tax returns. Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks.

September 13th 2021. The Internal Revenue Service has announced that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. You cannot withhold UI tax from the wages you pay to employees.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Minnesota Unemployment Refund Update.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. We know these refunds are important to. The Center Square The Minnesota Department of Revenue will start sending out more than 540000 tax returns impacted by tax law changes to Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness.

The Minnesota Department of Revenue. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. Update your address for year-end tax mailing - IRS Form 1099-G.

State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. To be sure you receive year-end tax information IRS Form 1099-G update your address now.

Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness. The Minnesota State Capitol in Saint Paul Minnesota. Your UI tax rate is applied to the taxable wages you pay to your employees.

Irs unemployment tax refund august update. September 15 2021 by Sara Beavers. Unemployment Tax Refund Update Irs Coloringforkids.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. Mail to Minnesota employers on or before December 15 2021. Unemployment benefits are taxable income under both federal and Minnesota laws.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. We know these refunds are important to those taxpayers who have.

Where is my federal unemployment refund. Tax rate factors for 2022. The legislation excludes only 2020 unemployment benefits from taxes.

Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. IR-2021-159 July 28 2021. In the latest batch of refunds announced in November however the average was 1189.

Mn Legislature Yet To Reach Deal On Unemployment Insurance Bring Me The News

Minnesota State Tax Refund Mn State Tax Brackets Taxact Blog

10 Best States For Entrepreneurs Small Businesses In The U S Small Business Infographic Business

Minnesota Unemployment Insurance Tax Rates 2022 Paylocity

State Of Minnesota Passes 2021 Tax Bill Bgm Cpas

Where S My Refund Minnesota H R Block

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Minnesota Unemployment Relief For Covid 19

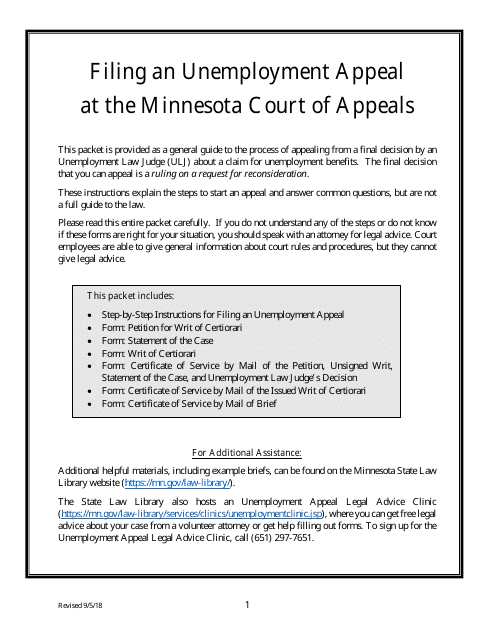

Minnesota Unemployment Appeal Packet Download Printable Pdf Templateroller

Mn Sales Taxes If You Re A Business That Sells Taxable Products Or Services In Mn Whether You File Monthly Or Quart Meant To Be Instagram Posts Sales Tax

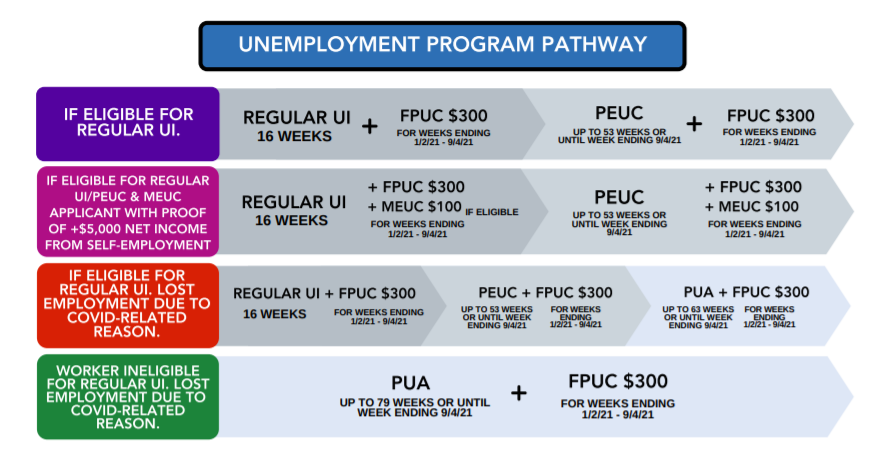

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

House Dfl Proposes Fifth Tier Income Tax For High Earners Some Relief For Ppp Loans And Jobless Benefits Wcco Cbs Minnesota

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Incom Starting A Daycare Daycare Business Plan Childcare Business

As High Unemployment Persists Minnesota Borrows To Pay More Benefits Federal Reserve Bank Of Minneapolis

Mn Dept Of Revenue Begins Processing Unemployment Insurance Compensation Ppp Loan Forgiveness Wcco Cbs Minnesota

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota